The main purpose of a credit union website is to provide useful information about its services and products to all potential customers. As many businesses have started operating online, credit unions have joined this trend and offer online services. Although the intention is to capture a greater number of customers, some credit union websites fail to achieve this goal by being inaccessible. Inaccessible web content means denying access to information to people with disabilities. People with impaired vision or hearing disabilities use various devices to aid them in navigating different websites online. Therefore, all credit union websites need to be ADA compliant, that is to be accessible to people with disabilities.

In this guide, we will explain what is ADA compliance, why it is important, and when it becomes mandatory for businesses that are open to the public.

What is ADA Compliance?

Simply put, the Americans with Disabilities Act or shortly known as the ADA compliance regulates website accessibility. Namely, many websites are designed in a way that imposes unnecessary barriers on people with disabilities. This makes it difficult or impossible for individuals with impaired vision or hearing to navigate the website, read and understand the content and use a service online. For instance, websites with poor color contrast make it difficult for color-blind people to read the text, or if only color is used to provide a certain piece of information. Furthermore, screen readers which people with impaired vision usually use to navigate the websites aren’t able to read the color of the text. So, if a red color designates a required field in a form the screen reader will not convey this message.

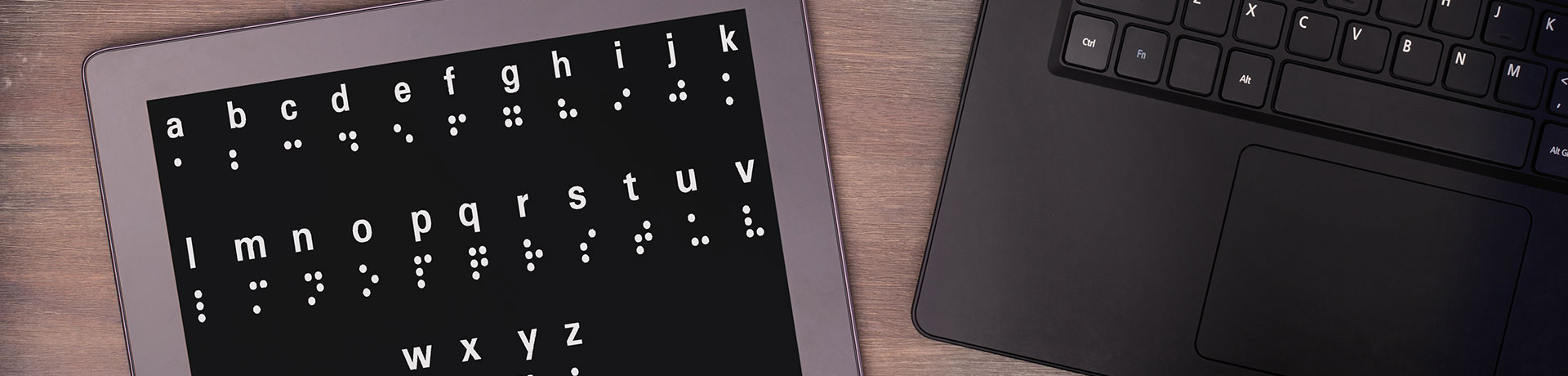

Another example of a website accessibility barrier is a lack of keyboard navigation, or ‘alt text’ description in the images. In this sense, not applying any captions in the videos will also cause a problem for the tools that people with disabilities use while navigating the website. All in all, any type of impediment caused by the credit union website that doesn’t allow all visitors to easily access all information is considered a web accessibility barrier, and this type of website is not ADA compliant.

Importance of ADA compliance for credit union websites

Having in mind that by being ADA compliant, a website provides equal access to all its potential customers it makes sense that it’s of primary importance for all businesses to implement it. Moreover, Title III of the ADA stipulates that all businesses that are open to the public are required to be compliant with it. In other words, if a website is not ADA compliant it means that it discriminates against people with disabilities.

Credit unions, as businesses open to the public, are required to follow this regulation and provide appropriate communication aids and services which are also known as auxiliary aids and services. Here are included any type of interpreters, captions, or assistive listening devices. In this way, credit unions can effectively communicate with individuals with disabilities and allow them to use their services and read their websites properly.

What are the consequences if a credit union website is not ADA compliant?

Website accessibility is no longer merely a recommendation, but with this regulation, it has become mandatory for businesses open to the public. Earlier this year, more precisely in March 2022, the Department of Justice finally released its first official guideline on website accessibility requirements under the ADA. In that sense, if a website is found to be non-compliant with the Americans with Disabilities Act then it is at great risk of being penalized or legally pursued. The most common consequences of not following the ADA compliance are civil fines. These fines can be in the range of $55,000 to $75,000. Moreover, if a website is found to be inaccessible for a second or third time, the fines can rise up to $150,000. It’s worth noting that businesses should also anticipate additional costs for plaintiff or lawyer fees which will be on top of the fines.

As a result of this official guidance on ADA website compliance, the Department of Justice has already reached several settlements with various businesses in the course of legal proceedings. In addition, since 2020, the number of businesses with federal lawsuits due to web inaccessibility has only been increasing, particularly in the state of California. Even many law firms such as the Pacific Trial Attorneys representing plaintiffs with disabilities have started sending demand letters to companies due to their web inaccessibility. There are over 4000 ADA cases that are now resolved and many more pending. In order to avoid getting involved in any lawsuits or being at risk of getting penalized, businesses should take this guidance seriously and make their websites ADA compliant.

How to make your credit union website ADA compliant?

Finally, making your credit union website ADA compliant is not a difficult task. It doesn’t require any big investments and you will be reaching a wider audience. Not to mention the fact that you will avoid any legal fees and negative publicity which can have a serious impact on your business. The easiest way to make your credit union website ADA compliant is to follow the Website Content Accessibility Guidelines (WCAG) accessibility standards which provide recommendations for website developers. However, the most important thing is to get legal counsel and reach out to professionals who can help you in the process. The team at Banksite Services has the expertise and experience in implementing ADA accessibility modules for many bank websites, therefore your problem can be solved by simply contacting us and implementing our action plan.