If you are a marketer working for a credit union, you probably know by now it is of the utmost importance to be compliant with the Americans with Disabilities Act (ADA). Failing to be compliant in various areas can result in lawsuits, fines, bad press, etc. And of course, you don’t want that! Just as a reminder, ADA, signed into law by President H.W. Bush in 1990, is a civil rights law, that prohibits discrimination based on disabilities. This Act alone helped mold the way Americans interact with their financial institutions.

In the past, ADA compliance was primarily concentrated on the physical locations of the credit unions, making them safe and accessible for people with disabilities. But now, as more financial institutions continue to migrate to the digital world it is key that the websites follow the standards, making it accessible to everyone. These standards dictate methods for how a website is programmed, designed, how should the text be written, and what color combinations are allowed. Also, every online service provided by the credit union must provide an adequate level of accessibility for all users.

4 steps to an ADA compliant website

The particular criteria that are included in the Web Content Accessibility Guidelines 2.1 (WCAG) have a total of 38 “checkpoints” used to evaluate the online content found within each website. These checkpoints are grouped into four categories.

- Perceivable – Information and user interface components must be presentable to users in ways they can perceive(e.g. Alt tags that state what the item actually does).

- Operable – User interface components and navigation must be operable (e.g. you must be able to navigate the website using a keyboard as well as a mouse).

- Understandable – Information and the operation of the user’s interface must be understandable (e.g. error messaging on a form should make sense).

- Robust – Content must be robust enough so it can be interpreted reliably by a wide variety of user agents, like assistive technologies.

Perceivable

Text Alternatives

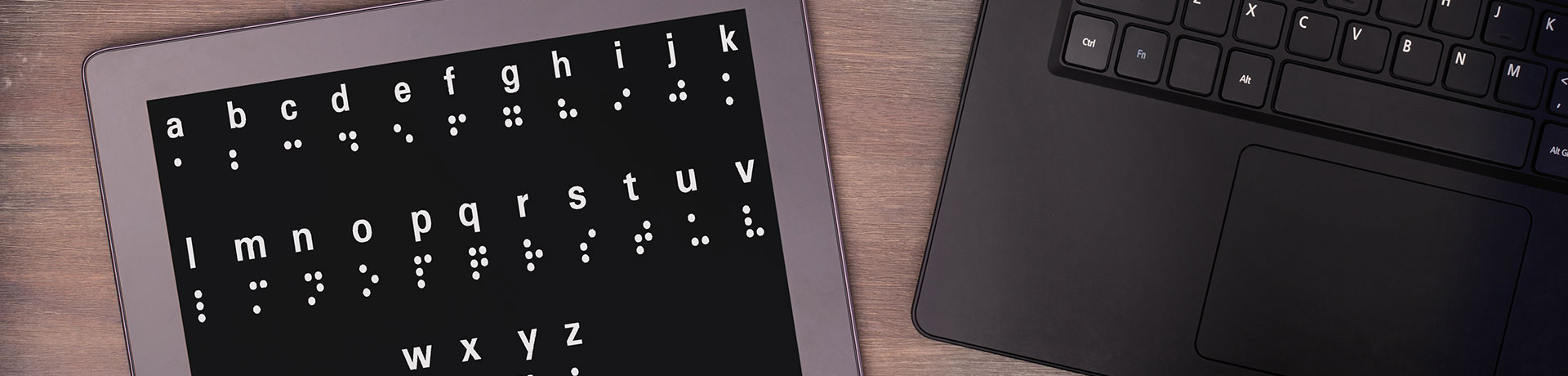

Your website must provide text alternatives for any non-text content so that it can be changed into other forms people need, such as large print, braille, speech, symbols or simpler language.

Time-based Media

Provide an alternative (e.g. transcript) for time-based media like audio or video, that presents equivalent information or links to textual information with comparable information for non-prerecorded media.

Adaptable

Create content that can be presented in different ways, without losing its context, like structure or information.

Distinguishable

Make it easy for users to see and hear content, including separating foreground and background, by using readable fonts and larger font sizes.

Operable

Keyboard Accessible

Make all functionality available from a keyboard. This doesn’t discourage providing mouse input or other input methods in addition to keyboard operation.

Timing

Allow users enough time to read and use the content. This ensures that users can complete tasks without unexpected changes in content that are a result of a time limit.

Seizures and Physical Reactions

Do not include design elements that are known to cause seizures (e.g. rapid flashing).

Navigable

Provide multiple ways to allow users to navigate content including obvious links and other techniques.

Input Modalities

Make it easier for users to operate functionality through various inputs beyond the keyboard. This requirement applies to web content that interprets pointer actions (i.e. this does not apply to actions that are required to operate the user agent or assistive technology).

Understandable

Readable

Make text content readable and understandable via styling and other techniques.

Predictable

Make web pages appear and operate in predictable ways.

Input Assistance

Assist users with web experience, correct mistakes, and describe errors in the text.

Robust

Compatible

Maximize compatibility with current and future user agents, including assistive technologies.

ADA Compliance audit

For the credit union website, it’s good to have regular audits. There are three main stages of this process – automatic, manual, and functional. Automatic testing does a high-level scan on the entire website to ensure that the main areas like structure are compliant. Manual means having one of your teammates drills down and fixes an error like images missing alt text. Functional testing is done by testers that have disabilities. These testers flag and document any difficulties that they might find.

Following ADA guidelines not only ensures that the credit union is inclusive but also ensures that your client’s individual needs are taken into consideration. Maintaining website compliance with ADA accessibility standards is an ongoing process that requires quite a lot of your time. For any guidance with making your website ADA compliant contact our team at CUWebsite Service.